And it is subject to handling as the input to be given for the time period is decided by the user, not by the defined formula. It calculates the rate of return steadily over the period of time with its compound assumed. It is very helpful in comparing different investments which have the same instability. The main part is, CAGR is a very easy and handy method to calculate the rate of return simply with 3 attributes. One can check the two different investment CAPG and how well one is performed over the other investment so one can go with the well-doing investment. Relevance and Uses of CAGR FormulaĬAGR is the best measure for calculating the yield out of an investment that can increase or decrease in value over a certain period of time.

CAGR FORMULA EXCEL FULL

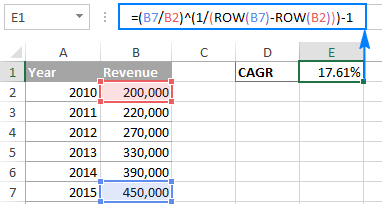

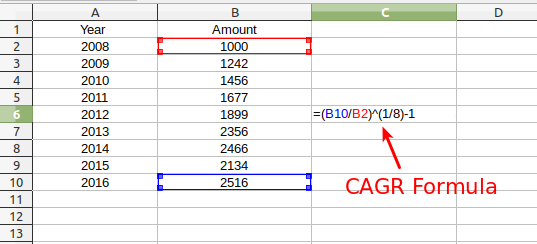

Otherwise, we can consider the full years. For the calculation, if the year-end prices are given, we should consider the completed years only. There can be confusion in finding the number of years in some cases. Step 4: Apply all the values in the above equation to find out CAGR. So the above formula can be rearranged to be like below.ĬAGR = (EV / BV) (1 / NY) – 1 = (EV / BV) (365 / TND) – 1 Otherwise, if we want this to be in days, we can rearrange the exponential form into 365 / TND, in which TND is a total number of days. Say if we want to calculate the CAGR in terms of the year, the exponential form will be 1 / NY.

It totally depends on how we want to calculate it. CAGR can be in the year’s form or in days form. Step 3: Note down the value of variable NY, which represent the number of years.

We should assume that each year-end, the yield is being reinvested. Step 2: Note down the value of BV, which is nothing but the present value or the beginning price. However, the result value of CAGR is considered in giving % only. If it is given in the % value, the calculating person has to convert that to price with the help of the beginning price and then should use it for calculation. However, the End value for each year can be either directly given or in the percentage of growth rate each year. Here EV represents the End Value or future price of an investment. Consider at the time of investing it is RS.4000. Let us assume the price of an investment like below. So it is 3, not 4.ĬAGR is calculated using the formula given below So it is a must to consider only the completed years. But these prices are the year-end prices, not the annual prices.

Here the total number of years given is 4.

0 kommentar(er)

0 kommentar(er)